income tax rates 2022 south africa

Taxable income Rates of tax R0 R216 200 18 of each R1 of taxable. Tax rates are proposed by the Minister of Finance in the annual Budget Speech and fixed or passed by Parliament each year.

Crypto Assets Tax South African Revenue Service

Reduction in corporate income tax rate and broadening the tax base.

. Use our free online income tax calculator to work out your monthly take-home pay and view the income tax tables for individuals for the 2023 tax year. 2022 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in South Africa. Non-residents are taxable on SA-source income.

Taxable Income Tax Rate. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Rate of tax R R1 R216 200.

People living in Ivory Coast are giving away a whopping 60 of their income to the government and. Year ending 28 February 2022. R70 532 31 of taxable income above R337 800.

The Personal Income Tax Rate in South Africa stands at 45 percent. Most state governments in the United States collect a state income tax on all income earned within the state which is different from and must be filed separately from the federal income tax. In this section you can find a list of income tax rates for the past five years for.

R38 916 26 of taxable income above R216 200. Information is recorded from current tax year to oldest eg. 2023 tax year 1 March 2022 28 February 2023 23 February 2022 See the changes from the previous year.

2021 and 2022 tax years. R 0 - R 216 200. Personal Income Tax Rate in South Africa averaged 4124 percent from 2004 until 2020 reaching an all time high of 45 percent in 2017 and a record low of 40 percent in 2005.

Personal income tax rates. R216 201 R337 800. A South African SA-resident company is subject to corporate income tax CIT on its worldwide income irrespective of the source of the income.

You can also see the rates and bands without the Personal Allowance. The country with beach resorts rainforests and a French-colonial legacy taxes its citizens has a 60 on income tax the highest in the world. You do not get a.

Personal Income Tax Rate in South Africa averaged 4124 percent from 2004 until 2020 reaching an all time high of 45 percent in 2017 and a record low of 40 percent in 2005. South Africa Residents Income Tax Earning Threshold in 2022. Income tax tables with rebates and car allowance fix cost tables for the 2022 tax year as provided by SARS.

Quick Tax Guide 202223 South Africa 3 Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2023 Taxable income Rate of tax R0 R226 000 18 of taxable income R226 001 R353 100 R40 680 26 of taxable income above R226 000 R353 101 R488 700 R73 726 31 of taxable income above R353 100. Income Tax Threshold amounts Annual Age Group. This page provides - South Africa Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar.

R 38 916 26 of amount above R 216 200 R 337 801 R. For tax years ending before 31 March 2023 the CIT rate applicable to the corporate income of both resident and non-resident companies is a flat 28. The rates for the tax year commencing on 1 March 2022 and ending on 28 February 2023 are as follows.

R216 201 R337 800. R70 532 31 of taxable income above R337 800. YourTax Tax calculator Compare yearly tax changes.

Rate of tax R R1 R216 200. If you are looking for an alternative tax year please select one below. There are seven federal income tax rates in 2022.

Calculate your income tax for 2021 2022. The Personal Income Tax Rate in South Africa stands at 45 percent. R337 801 R467 500.

2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000. The same rates of tax are applicable to both residents and non-residents. Progressive tax rates apply for individuals.

The below table shows the personal income tax rates from 1 March 2022 to 28 February 2023 for individuals and trusts in South Africa. Income tax rates 2022 south africa. 2023 2022 2021 2020 2019 2018 2017 2016 2015 etc.

South Carolina tax forms are sourced from the South Carolina income tax forms page and. 18 of taxable income. Secondary 65 to 75 R861300.

In this section you will find the tax rates for the past few years for. Tertiary 75 and older R287100. R337 801 R467 500.

If you are 65 years of age to below 75 years the tax threshold ie. You are viewing the income tax rates thresholds and allowances for the 2022 Tax Year in South Africa. This page provides - South Africa Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable. 8 rows Non-residents are taxed on their South African sourced income. 2021 and 2022 tax years.

Tax calculator 2023 current Tax calculator 2022. The reduction in the corporate income tax rate would be paid for with the introduction of measures. 18 of taxable income 226001 - 353100.

The 2022 budget speech delivered 23 February 2022 announced that the corporate income tax rate would be reduced to 27 from 28. R 216 201 R 337 800. Before the official 2022 South Carolina income tax rates are released provisional 2022 tax rates are based on South Carolinas 2021 income tax brackets.

Year ending 28 February 2022. A new tax reality Budget 2021 3 Tax Rates year of assessment ending 28 February 2022 TaxThresholds Age Threshold Below age 65 R87 300 Age 65 to below 75 R135 150 Age 75 and older R151 100 Trusts other than special trusts will be taxed at a flat rate of 45. 40680 26 of taxable income above 226000.

R38 916 26 of taxable income above R216 200. Announcing the projected budget for. Quick Tax Guide South Africa 2122 Individuals Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2022 Taxable income Rate of tax R0 R216 200 18 of taxable income R216 201 R337 800 R38 916 26 of taxable income above R216 200.

18 of taxable income. The 2022 state personal income tax brackets are updated from the South Carolina and Tax Foundation data. Taxable income R Rates of.

On this page you will see Individuals tax table as well as the Tax Rebates and Tax Thresholds scroll down. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

Average Income Tax Rates Comparisons South African Revenue Service

How To File Your Income Taxes In South Africa Expatica

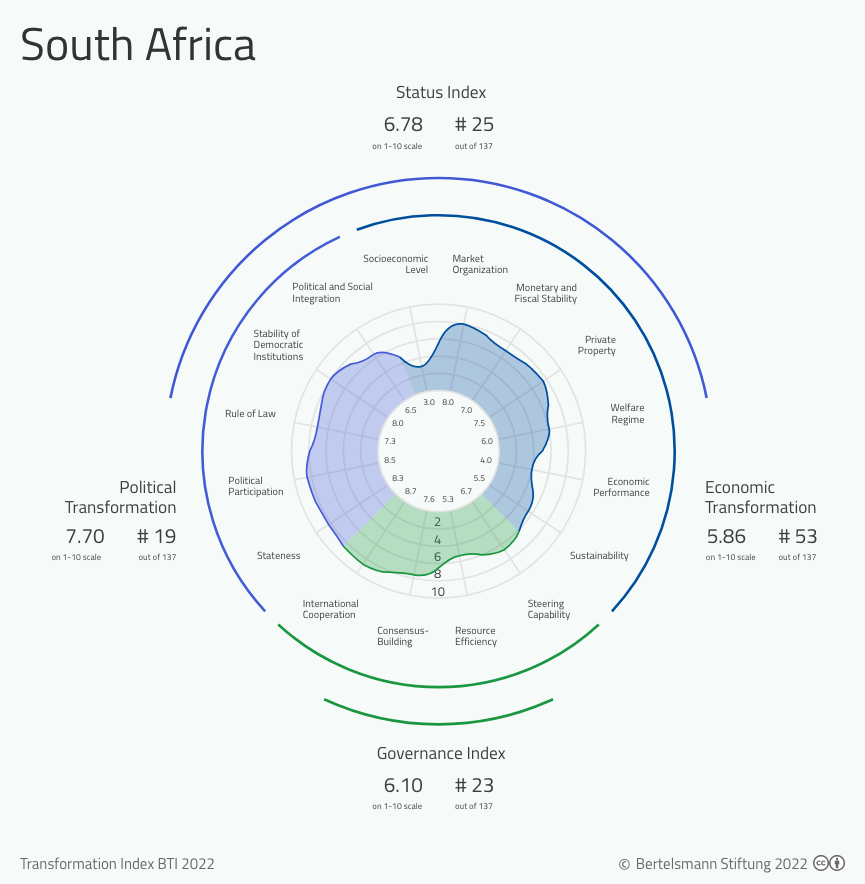

Bti 2022 South Africa Country Report Bti 2022

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

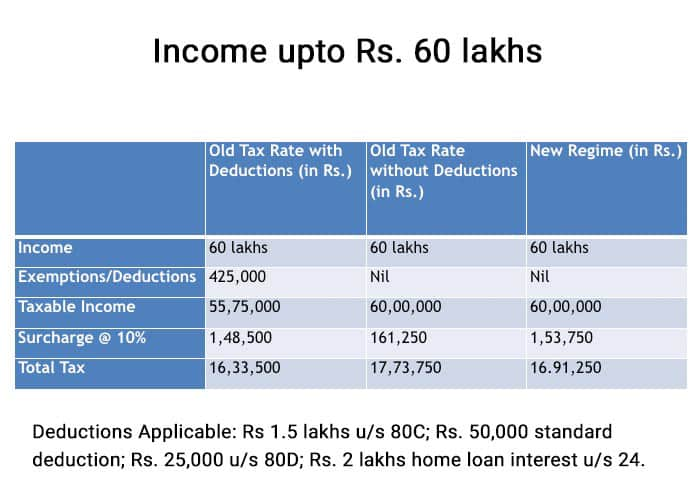

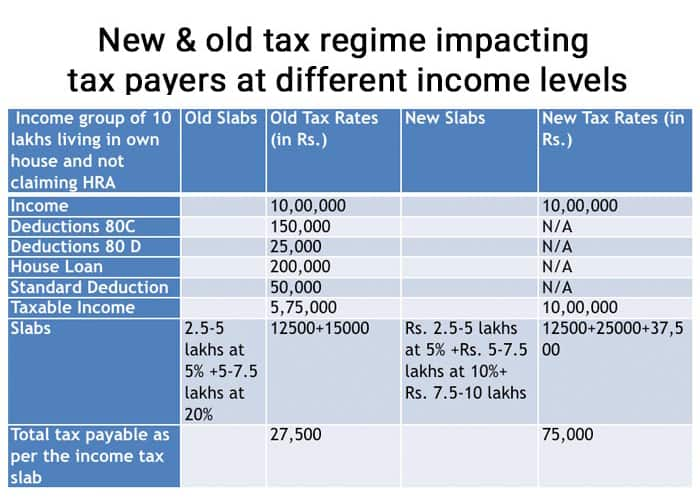

Old Vs New Income Tax Slab Policybazaar

The New Global Tax Deal Is Bad For Development

The New Global Tax Deal Is Bad For Development

How Changes To South Africa S Value Added Tax Affect Compliance Among Small Firms

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Average Income Tax Rates Comparisons South African Revenue Service

Corporate Tax In South Africa A Guide For Expats Expatica

Corporate Tax In South Africa A Guide For Expats Expatica

Tax And Fiscal Policies After The Covid 19 Crisis

How To File Your Income Taxes In South Africa Expatica

Corporate Income Tax Definition Taxedu Tax Foundation

How Does Auto Assessment Work South African Revenue Service

Old Vs New Income Tax Slab Policybazaar

How Much You Will Be Taxed In South Africa In 2022 Based On What You Earn